Automakers struggle with reduced demand for electric vehicles, leading to layoffs and production cuts while China dominates the EV market, causing Wes

…

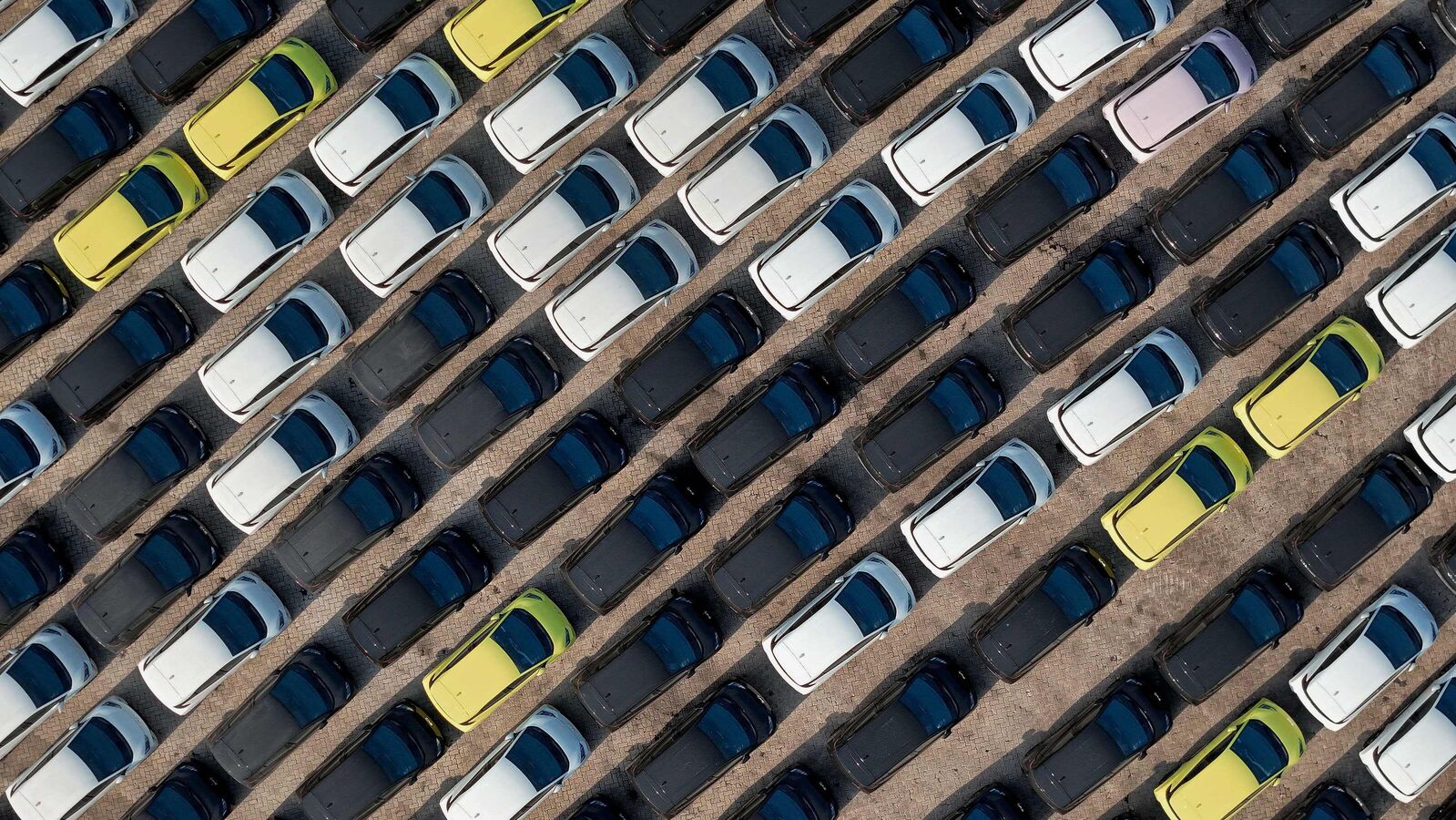

An increasingly weaker demand for electric vehicles has left automakers in the deep end trying to cut costs through layoffs and revised production output plans. Due to a global economic slowdown, consumers find themselves tackling elevated inflation along with high rates of interest. This has resulted in a reduced demand for EVs in exchange for a shift towards relatively cheaper hybrid vehicles. China as the largest EV market accounts for 60 per cent of all EV sales in the world. While increased offerings from local players have caused Western brands to lose a chunk of their global market share, the country’s real estate crisis has caused an overall slowdown in EV demand.

Large-level growth has steadily risen over the past decade. According to a report from the International Energy Agency (IEA), total EV sales in 2023 had reached 14 million, and electric cars accounted for 18 per cent of all cars sold. This is more than six times higher than what was recorded in 2018. These metrics however remain concentrated in just a few markets where China, Europe, and the United States account for nearly 95 per cent of global EV sales.

In spite of such growth, a real estate crisis in China and a global economic recession have been the leading causes of the current fall in demand for EVs. A Bloomberg report said that while local Chinese players have gained a greater foothold on the market over time, the real estate crisis has held the economy up, leading to an overall weakened demand for EVs. A Goldman Sachs report adds that lower prices for used EVs, the uncertainty of elections around the world, and the shortage of charging stations were among the driving factors around the decline of demand.

The demand shortfall has led the biggest automakers to control costs as much as they can without falling into oversupply. This often means brands have to carry out price cuts that eat into the manufacturer’s bottom line. While Porsche AG asked the Chinese government for compensation after selling at a loss, other brands had to scrap billion-dollar deals.

In October 2023, Honda and General Motors announced that they were going to end a $5 billion plan for the development of low-cost electric cars. In January 2023, Tesla shareholders erased $80 billion from the company’s valuation amid a decline in sales growth.

Lucid Group reported in May that they would reduce their US workforce by 6 per cent, while Rivian said that it cut 1 per cent of its workforce in a second round of layoffs this year.

First Published Date: 29 May 2024, 07:31 AM IST